Traditional ira withdrawal tax calculator

Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. For assistance please contact 800-435-4000.

Traditional Vs Roth Ira Calculator

Yes Spouses date of birth Your Required Minimum.

. This calculator is undergoing maintenance for the new IRS tables. Here you can also check the amount of fixed annual contribution you. If you are age 72 you may be subject to taking annual withdrawals known as.

Whenever you take money from a traditional IRA you have to pay taxes at your ordinary or marginal income tax rate. Paying taxes on early withdrawals from your IRA could be costly to your retirement. If you are under 59 12 you may also.

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth.

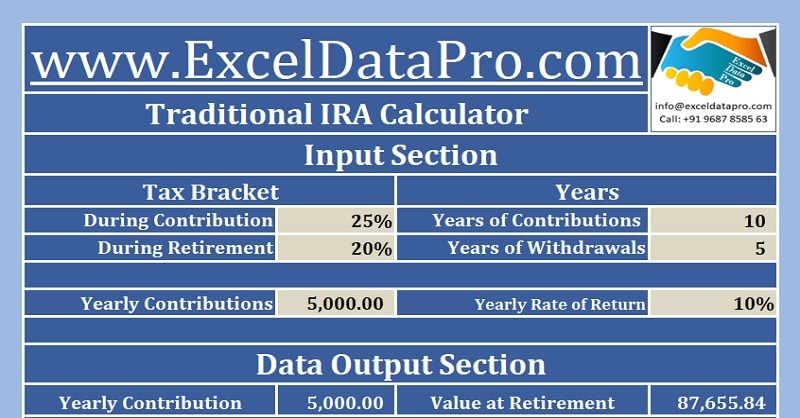

The traditional IRA calculator is an easy tool to calculate the maturity amount you will get on your fixed annual contribution. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. Traditional IRA Calculator Details To get the most benefit from this.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. Traditional IRA Calculator can help you decide.

The after-tax cost of contributing to your. Since you took the withdrawal before you reached age 59 12 unless you met one. Required Minimum Distribution Calculator.

Choosing between a Roth vs. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. If you withdraw money from your traditional IRA before.

Traditional IRA depends on your income level and financial goals. For example if your traditional IRA contains 26000 of nondeductible contributions and has a value of 41000 15000 of the traditional IRA is taxable. Discover The Answers You Need Here.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

Download Free Traditional Ira Calculator In Excel

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Tax Calculator Software

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Traditional Ira Calculator Excel Template Exceldatapro

Federal Income Tax Templates Archives Msofficegeek

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Ira Calculator Excel Template Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Traditional Vs Roth Ira Calculator